Banking in Malta

The framework for banking in Malta has long been considered the model for other countries to recreate. Renowned transparency through a highly regarded regulatory framework, Malta is the home of some of the best banks in the world. There are many banking groups in Malta well known for their diversity and competitive edge.

Nestled between north Africa and southern Europe, the small republic belongs to the EU, but thanks to a long-established and well governed banking sector, Malta has remained largely sheltered from the financial crisis witnessed across the rest of the continent. The nation’s banking system relies on a successful and well administered relationship between the central bank and all others registered in Malta. As such there is healthy competition to become recognised as the best banking group in Malta.

Here, World Finance investigates some of the factors that have fortified this leading region, consider some of the other financial products long-recognised and applauded in the market, and speaks with Banif Bank’s Joaquim Silva Pinto, as he accepts the World Finance award for Best Banking Group, Malta, 2011.

In considering allocating this particular award, the magazine’s highly regarded judging panel was able to rely on it’s research team to consider a variety of different factors. Issues such as the group’s prerogative of what constitutes good customer service and how it is implemented, it’s strategy moving forward, and the clarity and brevity of the group’s structure.

In as competitive a market as the banking in Malta, the judges felt that Banif Bank surpassed expectations for the year, continuing to uphold the strong reputation it has cast in recent years. As a premier banking group in Malta, Banif offer a wide range of products and services on the market.

Regulatory framework

Malta’s financial sector is a child of the Bank of England, a relationship that helped it float through the crisis of 2008. Indeed, as professor Joe Bannister, long-standing chairman of the Malta Financial Services Authority, says, “the financial crisis did not come to Malta”.

The first governor of the central bank was Dr Phillip Hogg, a senior official of the Old Lady of Threadneedle Street. Although the bank and the entire industry have undergone major changes since the central bank was established in 1968, particularly when Malta became a full member of the EU and the eurozone in 2008, both have always been run according to the principles of the Bank of England.

Highly vigilant, the central bank’s main and constant preoccupation is the stability of the republic’s financial industry. It constantly monitors the banking infrastructure and the markets under a comprehensive early warning system that alerts the institution to any emerging risks and potential shocks. If they do occur, the bank deploys stress-tested policies to manage them.

A remarkably accessible regulatory system has played a big role in the rapid but responsible growth of the financial sector. The MFSA maintains a deliberate policy of simplicity to ensure that it is effective but without burdening bank management with undue bureaucratic obligations. Under the one roof, the MFSA has responsibility for banking, insurance and investment business. Regulatory standards are based on those of the European Union and constantly reviewed to reflect best practice. Internationally, the MFSA punches far above its weight in regulatory affairs and is recognised as a leading force in forums within the OECD, Europe and Commonwealth where it maintains close ties.

Malta makes no apologies for its comprehensive regulatory regime. “There is a huge respect for regulation here, and the MFSA actively encourages a culture of openness between regulators and businesses,” says professor Bannister.

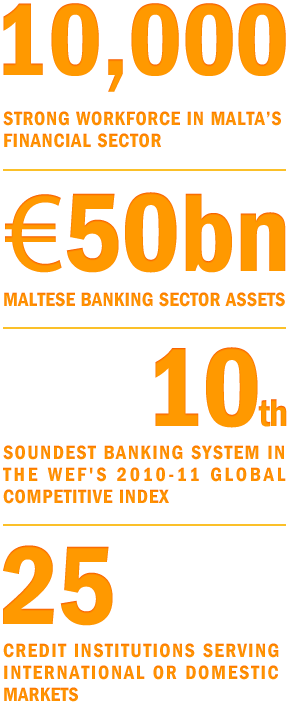

Banking in Malta is an entity of its own. The performance of the banking sector in the immediate aftermath of the crisis provided proof of the robustness of the entire system. No banks had to be bailed out. Shortly afterwards, the ECB designated Malta as having the most sound financial sector in Europe. The numbers underpin that judgement, with average tier one solvency ratio – the prime standard of a bank’s soundness – standing at 15 percent compared with an 8.3 percent average for EU institutions as a whole. A banking group in Malta might be expected to drive the market through a variety of different offerings.

Popular financial instruments

Insurance – and corporate insurance in particular – has long been one of Malta’s proudest industries. Operating under the umbrella of the Malta Insurance Corporation whose watchwords are “fairness, transparency and knowledge”, the sector is an historic one with considerable depth. Today it boasts a full complement of life and non-life insurers, reinsurers and a fast-growing international captive sector domiciling itself in the republic.

Malta boasts particular expertise through an experienced cadre of underwriters, brokers and insurance managers supported by risk managers and actuaries with deep local knowledge. A number of licensed insurance management consultancies, both international and boutique local firms, are also available to provide advice to new arrivals.

A highly international industry, the sector writes about 75 percent of its business outside Malta on a cross-border basis. However the domestic market is also active, with nearly €500m booked in gross premiums by Maltese firms alone, including general business written with overseas entities.

A runaway success in attracting insurance firms since 2004 has been a unique corporate structure that allows start-ups to grow in a relatively protected environment. Known as PCC (for protective cell company), the structure means that one “cell” – a clearly demarcated, stand-alone business within the group – can operate without running the risk of its assets being subsumed by the liabilities of the other cells. The structure is particularly attractive to medium sized corporate groups wishing to establish their own insurance vehicle.

An extra incentive is Malta’s effective tax rate for insurance business written outside the republic. After deducting all refunds, it works out at five per cent after deducting all available refunds, less than half the rate of Ireland, the closest competitor.

The imminent Solvency II regulations have also attracted a number of non-EU firms because of the requirement to have an office within the EU to write business there. National regulator MFSA provides the training and other support necessary to prepare the industry for Solvency II’s projected arrival in 2013. A banking group in Malta might be expected to know these issues inside out, and be well prepared for their implementation.

The adherence of Malta’s accounting community to IFRS standards has also proved an important factor for foreign entities.

Personal finance

Banking in Malta is an opulent and open market. Financial institutions offer a broad range of products from savings and current accounts for a minimum deposit of as little as €150, loans such as individual overdraft facilities, credit cards and stockbroker services.

Deposits are covered by the Depositor Compensation Scheme that guarantees customer savings up to a maximum of €100,000. That surety underpins a consumer-friendly, highly flexible portfolio of accounts for students, high savers, salary-earners and pensioners.

As well as mortgages, numerous financing options are available such as €30,000-maximum loans for everything from home renovations to automobiles. One bank offers a “green energy” loan for environmentally friendly products such as solar water heaters, double or triple glazing, heat-storing roof panels and battery-powered cars. Interest-free periods may extend for up to a year.

Banking groups in Malta are under the watchful eye of the central bank. Regardless, business is booming home, as strict rules have always been adhered to. Well regulated, loans for local residents may be written for up to 90 percent of the property’s purchase price. In general, mortgage products accommodate the priorities of most borrowers with loans for first and second-time buyers, bridging finance, interest-only (for instance, for up to six years), fixed-interest and other packages are available from different banks in Malta.

Similarly Malta prides itself on its retail insurance products, which have long been one of the pillars of the broader financial services market. Total premiums written by domestic firms exceed €1bn a year. They include medical cover for expats and travellers of all kinds including missionaries and students. Every kind of consumer durable can be insured. Life cover is a particularly fast-growing market, with premiums rising by 48 percent in 2010.

The pension market is dynamic. Under pressure from the European Commission, Malta is working towards a more sustainable retirement system. Maximum payments from the first-pillar, state system currently amount to an unfundable €12,000 – €13,000 a year, and the EC has urged the government to address the deficit and encourage private pension saving. In September the Maltese Association of Retirement Scheme Practitioners was launched to push for a second pillar and the expected result will be the emergence of a more developed market.

Corporate finance

Malta is rapidly developing into a full-fledged financial services centre in the Mediterranean that serves as a bridge between Europe, North Africa and the Middle East. Lying 93 km south of Sicily and 288 km east of Tunisia, it has exploited its geographic advantages to maximum effect by establishing formal links with other countries. In turn, these links translate into considerable advantages for its financial industry and companies, both domestic and international.

For instance, Malta has long been recognised for the breadth and depth of its tax treaties with other countries, and has been steadily increasing them year on year. Now numbering over 60, they have had the effect of attracting foreign entities seeking to piggy-back them into Europe and other regions. For instance, the treaty negotiated in 2010 with the USA has already persuaded several American financial companies, and especially captive insurers, to base their European headquarters in Malta. Currently, the government is working to extend these treaties further, in particular into Latin America and other emerging markets.

Notably business-friendly, the government is also looking at introducing a special, fixed-period tax rate for in-bound professionals employed by foreign firms with branch offices on the island. The purpose is to provide an environment for their expertise to percolate through the financial community and enrich the pool of domestic commercial talent.

Even before the recent influx of newly domiciled companies, banking in Malta attracted companies by offering a wide portfolio of products comprising retail and private banking, trust business, investment banking, trade finance, treasury operations and syndicated loans. But as more large-scale, international banks establish offices in the republic, the range of corporate services is expanding rapidly. Increasingly sophisticated solutions are available in the form of treasury services in payment and cash management, and in the provision of liquidity and funds. Foreign-exchange desks deploy considerable expertise in hedging against potentially hostile movements in currency and interest-rate movements. Similarly, asset management services are expanding all the time.

In addition, a widening range of non-bank financial institutions supplement and overlap some of the full-bank services. Their activities include factoring, money transmission services, issuing and administering means of payments, guarantees and commitments and foreign exchange. (These institutions are not permitted to take deposits or other repayable funds from the public to fund their activities.) Banking groups in Malta have recently started to adapt.

Standards in the region

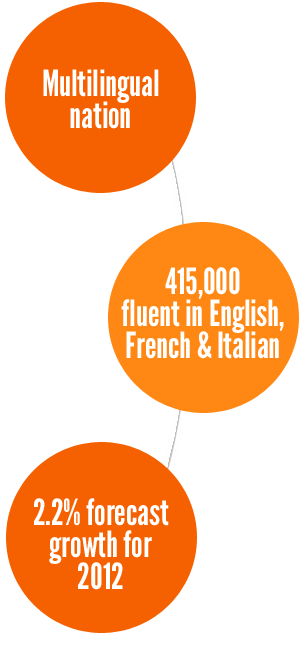

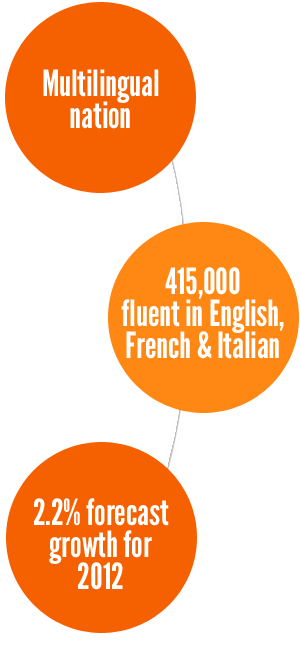

Malta’s position as a tourist destination is of considerable assistance to the business community because of the frequency of flights, availability of excellent hotels, restaurants and congenial climate. Air Malta runs almost daily routes into most European financial centres including Frankfurt, Munich, London, Milan and Rome. English is the first language in the commercial community, but many of Malta’s approximately 415,000 people are also fluent in French and Italian. The general result is that Malta has become something of an international hub, albeit with significantly lower costs than other financial centres.

According to the latest World Economic Outlook by the International Monetary Fund, Malta stands almost aloof from the eurozone’s problems. The economy is forecast to grow by 2.2 percent in 2012, slightly down on 2011 but far ahead of average growth in the EU. “Malta is performing above average next to the rest of the euro area and it’s not associated with the current turmoil on the markets,” according to an IMF official. Although Moody’s downgraded Malta’s government bond rating by a notch to A2, that is mainly because of its exposure to Europe.

Finally, the openness of the main regulator MFSA is routinely cited as a major attraction for the financial sector. Most discussions between the MFSA and firms take place on an open-table basis while the document-gathering dawn raids common in other jurisdictions are unknown. The MFSA, which prides itself on a “strict but fair” policy, sees its mission as doing what it can to help local and international firms to grow.

Although much new legislation has been introduced in recent years, the MFSA has taken care to prevent it from overlapping existing rules and regulations. Above all, explains professor Bannister, “we ensure there is no gold-plating involved,” which has reassured banking groups in Malta that business can and will continue to progress as normal.

Our winner

Banif Bank entered Malta three years ago, after carefully studying the market to assess the options for a new operator. Joaquim Silva Pinto looks back over those years of operation, from creating innovative products to embedding a reputation for quality customer service in Malta’s consciousness; and muses on applying Banif’s three ‘centaur values’ as the bank moves forward.

In selecting the World Finance Best Banking Group, Malta, 2011, the judges were highly impressed by Banif’s remarkable growth in both retail and corporate lending. The judges acknowledged that the bank’s remarkably impressive, diversified portfolio has guaranteed the organisation’s position within a highly competitive local market, as is the banking group model in Malta.

Adhering to the principles of the centaur values – which set an agenda for building long-lasting relationships with customers, employees, and the environment – Banif’s unique offering marries a wide range of innovative products with the highest standard in customer services.

In line with Banif Bank’s growth strategy, the group opened it’s ninth branch in early August. On welcoming the branch’s new customers, the bank group’s CEO noted that the expansion represented “an unequivocal demonstration of the soundness of the project and the commitment of the bank’s management and shareholders to reach their targets.”